18. decembar 2025 12:23

IMF: Second review under PCI for Serbia successfully concluded

podeli vest

Foto: shutterstock.com/JHVEPhoto, ilustracija

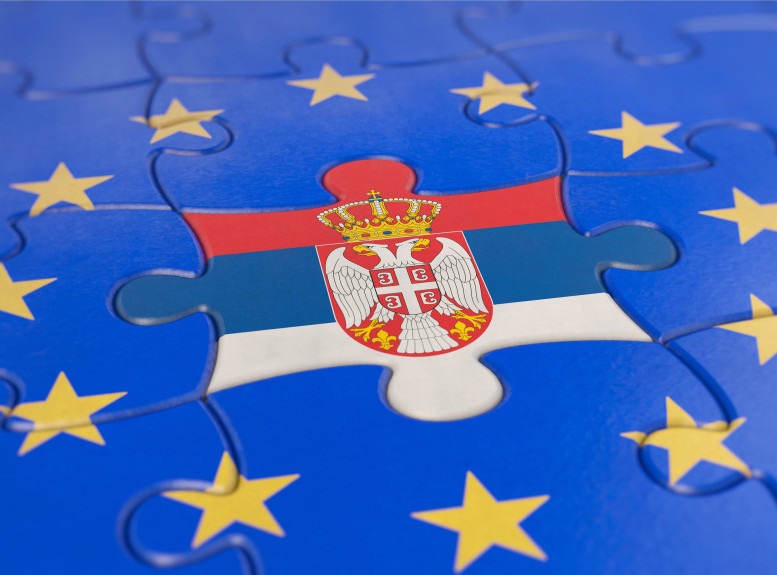

BELGRADE - The Executive Board of the International Monetary Fund (IMF) has announced that a second review under a Policy Coordination Instrument (PCI) for Serbia had been concluded successfully.

"Under the Policy Coordination Instrument, the authorities are advancing key structural reforms, including in public financial and investment management and energy sector, and have successfully completed the second review. Serbia’s growth has slowed amid rising domestic and external headwinds. Growth in 2025 is expected to be around 2 pct, before recovering in 2026 and 2027.

Prudent macroeconomic policies and strong buffers are helping Serbia navigate this challenging period. Fiscal discipline is being strictly maintained, and monetary policy remains cautious, preserving policy credibility," the IMF said in a statement.

"Economic activity has slowed amid rising domestic and external challenges. Real GDP growth is estimated at around 2 pct in 2025, before recovering to 3 pct in 2026. Headline inflation has eased to below the National Bank of Serbia’s target of 3 pct. The current account deficit is expected to widen in 2026, reflecting higher fuel import costs and EU restrictions on steel imports, before moderating from 2027.

Downside risks to the outlook are elevated but are mitigated by prudent macroeconomic policies and sizable buffers. Ample foreign exchange reserves, government deposits, and a resilient well-capitalised banking sector provide important support in navigating current challenges. Resolving the sanctions on the macro-critical oil company NIS would further reduce uncertainty.

Continued prudent policies are essential to safeguard credibility. Fiscal deficits are on track to remain below the agreed 3 pct of GDP ceiling, a key program anchor, supported by contained current spending and careful investment prioritisation. A restrictive monetary policy stance, including looking through temporary price fluctuations from recent price and margin controls, helps contain inflation risks stemming from minimum wage increases and higher energy cost.

Advancing structural reforms remain crucial. Fiscal transparency and accountability are being strengthened through continued reforms in public financial and investment management. Under new program commitments, public arrears are expected to begin declining from 2026. Diversifying natural gas supplies would further strengthen energy security, while recent increases in household electricity tariffs have improved the financial sustainability in state-owned energy enterprises, supporting critical energy investments going forward," it said.

At the conclusion of the Executive Board’s discussion on Serbia, IMF Deputy Managing Director Bo Li said that "growth has slowed amid domestic protests and heightened energy-security risks following sanctions on the macro-critical oil company NIS."

"Prudent macroeconomic policies, supported by strong engagement with the IMF, have helped Serbia build fiscal and external buffers that are proving valuable in navigating the current challenging environment. The government has met its deficit target and the National Bank of Serbia (NBS) has maintained appropriately tight monetary policy. The Policy Coordination Instrument (PCI) continues to anchor policy credibility and reinforce the authorities’ commitment to structural reforms.

Risks, including those linked to NIS resolution, have increased significantly, underscoring the need for continued prudent policies. The authorities’ priority is to maintain the fiscal deficit anchor of 3 pct of GDP or below, which requires strict adherence to wage and pension rules, investment prioritisation, and careful contingency planning. This discipline will preserve fiscal space to respond to shocks and support the continued decline in public debt. The authorities remain committed to strengthening public financial and investment management, including by clearing existing arrears and preventing new ones," Li said.